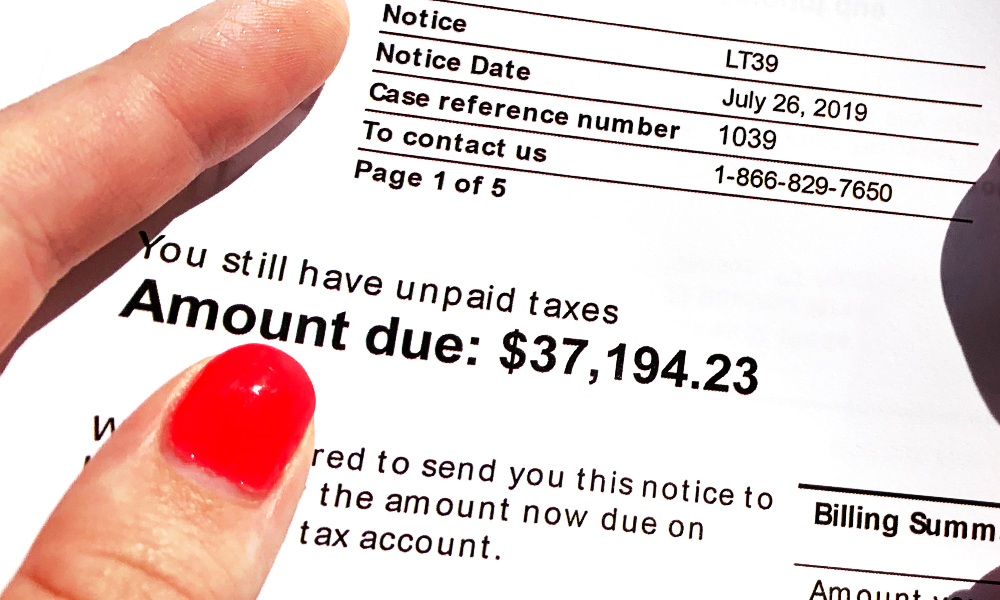

If you can’t afford to pay your tax bill, you must enroll in this program to stop the IRS from coming after you.

Don’t let the IRS trick you into thinking you don’t have options.

If you cannot repay your tax balance and/or the mountain of interest and penalties that has been accrued, you need to read this.

Because over 14 millions of US taxpayers owe a balance to the IRS, it’s no surprise that this program is being used by hundreds of thousands of people. In July, many taxpayers used this program to save them thousands in extreme tax relief.

This program is available to taxpayers, but the IRS does not want you to use it to its full potential.

Not only does enrolling in this program STOP IRS collection activities, harassment, and the accrual of penalties, it can also significantly reduce the amount of money that you owe.

The IRS infamously claims that repayment plans and high monthly fees are your only option to repay your tax debt but in reality, the IRS Fresh Start Program, offers over FIVE different resolution options that the IRS does not want you to know about because if you do, they lose money.

Check your eligibility to enroll with our free qualifier

Follow these simple steps to ensure that you don’t get mislead by the IRS.

First, if you owe significant tax debt and repaying that tax debt would put you or your family in a significant financial hardship – you may qualify for one or more Fresh Start Programs. Qualifying more more than one program can result in significant savings.

Next, to max out your savings, you’ll want to make sure you know all of your options before approaching the IRS. This way, you won’t be mislead by the IRS’s attempts to place you in a high-interest monthly payment plan.

Do not contact the IRS without knowing what your options are.

Not everyone takes advantage of these programs – here’s why. The IRS can be a tough beast to battle on your own. They have an army of collection specialists who’s sole job is to collect as much money from you as possible.

Many people who try to face the IRS alone without the proper information or support are often bullied into a resolution program that ends with them paying the IRS more than their original tax debt amount.

What’s the next step? Unknown to many taxpayers, you can check your qualification for the IRS Fresh Start Program for free before deciding how to move forward with your tax resolution.

There are over FIVE different IRS Fresh Start Programs – Which will get you the most savings?

STEP 1: Fill out our FREE tax relief qualifier

STEP 2: Complete your FREE consultation with a tax resolution officer to determine if you’re eligible for the Fresh Start Programs.

STEP 3: Stop the IRS from coming after you and possible save thousands!