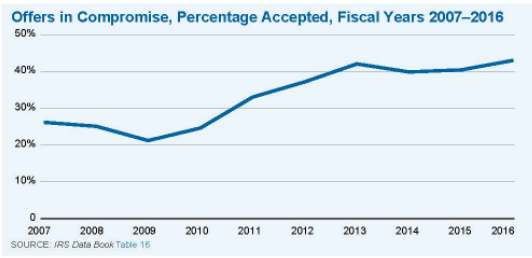

The IRS has been consistently wiping out millions in tax debt through the Fresh Start Program since its origin in 2007. It was expanded to accept even more taxpayers in 2012 which increased Americans’ savings significantly.

The program was designed to help alleviate debilitating income debt from taxpayers who struggle financially.

Additionally, studies have shown that when taxpayers work with a tax relief agency, their chances of succeeding in their OIC goes up simply because their cases are stronger when prepared by a professional firm.

How to Qualify

Qualifying for the IRS Fresh Start Program is relatively simple. Many tax relief firms are able to qualify you with limited personal information and a short phone call.

There are a number of terms that you must meet to qualify for the Fresh Start Program. Since no one’s situation is exactly the same, you won’t find clear indications online about what exactly you will need to qualify, however being able to prove a financial hardship is the most important element.

If you’re considering qualifying to the Fresh Start Program begin to get your financials in order or contact a tax relief firm who can assist you.

What Next?

Finding out if you qualify for the IRS Fresh Start Program is easy! Just fill out our brief survey, and you can see if you qualify for relief today.

Additionally, studies have shown that when taxpayers work with a tax relief agency, their chances of succeeding in their OIC goes up simply because their cases are stronger when prepared by a professional firm.

How to Qualify

Qualifying for the IRS Fresh Start Program is relatively simple. Many tax relief firms are able to qualify you with limited personal information and a short phone call.

There are a number of terms that you must meet to qualify for the Fresh Start Program. Since no one’s situation is exactly the same, you won’t find clear indications online about what exactly you will need to qualify, however being able to prove a financial hardship is the most important element.

If you’re considering qualifying to the Fresh Start Program begin to get your financials in order or contact a tax relief firm who can assist you.

What Next?

Finding out if you qualify for the IRS Fresh Start Program is easy! Just fill out our brief survey, and you can see if you qualify for relief today.

Want to see if you qualify for the Fresh Start Program? Click here to take our brief survey.Types of Relief The IRS Fresh Start Program offers two main types of relief. Installment Agreements, where the IRS and taxpayer agree on a pre-determined payment plan until the full debt is paid off, and Offer in Compromises (OIC) where the taxpayer and IRS negotiate a settlement offer. Traditionally, Offer in Compromises are more difficult to qualify for since one would need to prove a financial hardship as the reason for not being able to pay off their tax debt. However, since 2012, Offer in Compromise acceptance rates have been steadily increasing. Currently, the IRS accepts over 40% of OICs submitted.

Additionally, studies have shown that when taxpayers work with a tax relief agency, their chances of succeeding in their OIC goes up simply because their cases are stronger when prepared by a professional firm.

How to Qualify

Qualifying for the IRS Fresh Start Program is relatively simple. Many tax relief firms are able to qualify you with limited personal information and a short phone call.

There are a number of terms that you must meet to qualify for the Fresh Start Program. Since no one’s situation is exactly the same, you won’t find clear indications online about what exactly you will need to qualify, however being able to prove a financial hardship is the most important element.

If you’re considering qualifying to the Fresh Start Program begin to get your financials in order or contact a tax relief firm who can assist you.

What Next?

Finding out if you qualify for the IRS Fresh Start Program is easy! Just fill out our brief survey, and you can see if you qualify for relief today.

Additionally, studies have shown that when taxpayers work with a tax relief agency, their chances of succeeding in their OIC goes up simply because their cases are stronger when prepared by a professional firm.

How to Qualify

Qualifying for the IRS Fresh Start Program is relatively simple. Many tax relief firms are able to qualify you with limited personal information and a short phone call.

There are a number of terms that you must meet to qualify for the Fresh Start Program. Since no one’s situation is exactly the same, you won’t find clear indications online about what exactly you will need to qualify, however being able to prove a financial hardship is the most important element.

If you’re considering qualifying to the Fresh Start Program begin to get your financials in order or contact a tax relief firm who can assist you.

What Next?

Finding out if you qualify for the IRS Fresh Start Program is easy! Just fill out our brief survey, and you can see if you qualify for relief today.