As inflation rises, the federal government increases IRS funding by billions of dollars! IRS Collections increase and taxpayers seek the best relief through the IRS Fresh Start Program.

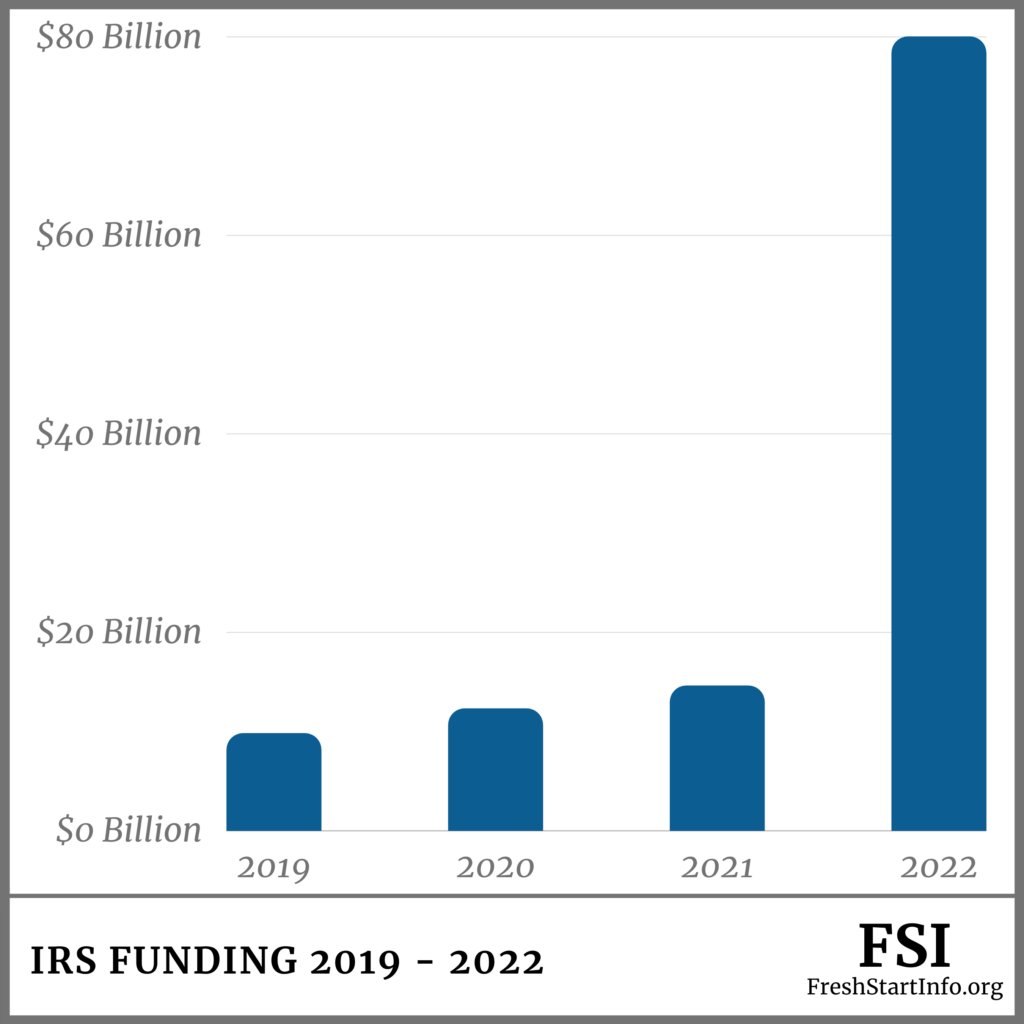

Unprecedented Inflation is ravaging Americans. The price of food, gasoline, and housing has suffered as a result. If that weren’t enough to make it difficult, the federal government released one of the largest funding packages to the IRS, to date. (as seen in figure a.)

This means the IRS is hiring new collections agents daily to come after Americans who owe taxes or have unfiled tax years. As technology advances, the IRS is now able to catch delinquent taxpayers with a lot more precision and in a fraction of the time. They have received just over $80 billion dollars in additional funding to assist in recouping past due tax debt in order to combat the out-of-control inflation.

However, many American taxpayers have been kept completely in the dark on how to qualify for relief programs with the IRS.

The reality is…the IRS doesn’t want you to know, that qualifying is easy. There are options for anyone to combat the IRS’ increased funding. FreshStart Info makes it easy to see if taxpayers qualify for tax relief options. Qualifying is free, easy, and takes 2 minutes.

As inflation rises, taxpayers seek the best relief through the IRS Fresh Start Program. Why is now the time to seek relief? Due to inflation, the IRS requirements to qualify for a reduction, and in some cases elimination of tax debt, are more lenient than ever before.

If you can relate to this or have concerns about being behind on your taxes, take a moment to fill out the free tax relief survey. This survey will help you better understand if you can qualify to have your past-due taxes settled for pennies on the dollar, or in some cases, eliminated entirely. It only takes 2 minutes to fill out. Learn more about how to get your IRS debt handled, and start living debt-free.