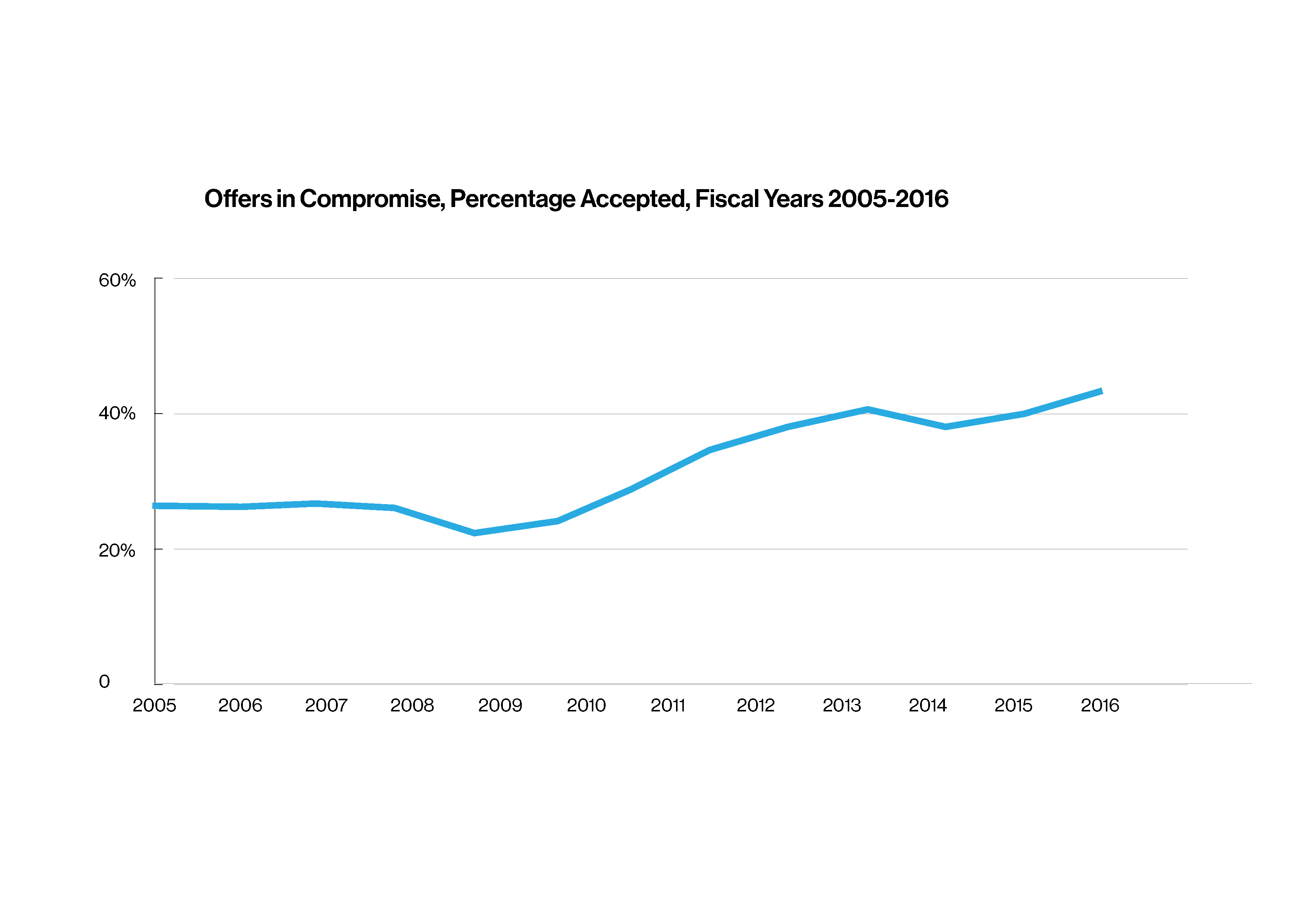

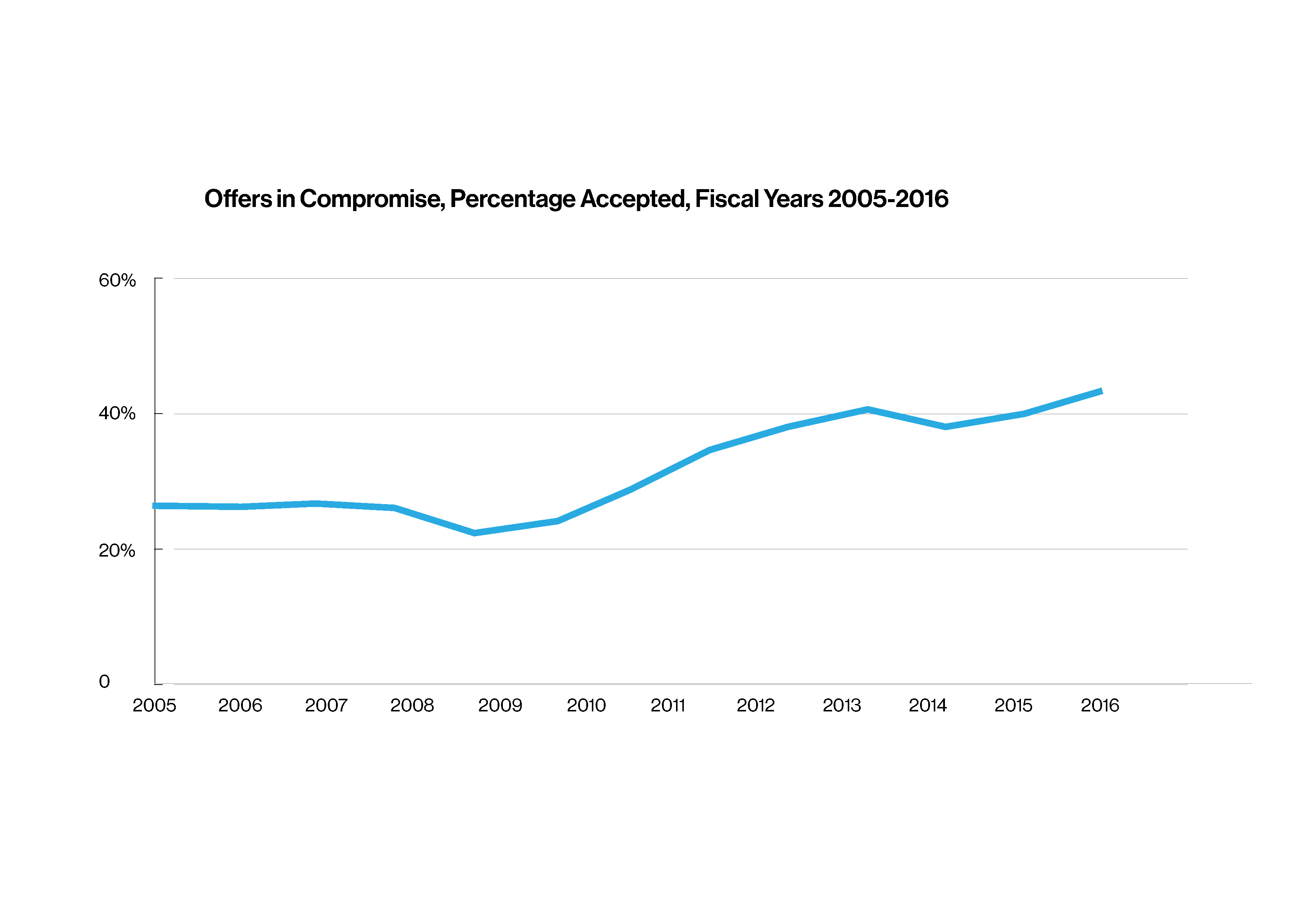

The IRS Fresh Start Program has been available to Americans for years, but there have been a dramatic increase participants since 2012.

This is partly due to the fact that nowadays more Americans than ever are qualified to participate in the program and are more likely to succeed in receiving an Offer in Compromise.

Want to see if you qualify for the IRS Fresh Start Program? Take our quiz to see if you qualify today!An Offer in Compromise (OIC) is when the IRS allows you to negotiate your total amount due down to an agreed upon settlement. Many times when people qualify for the OIC, they are able to prove a financial hardship which allows their debt to be reduced by thousands. The OIC has always been seen as a long-shot for the majority of taxpayers in tax debt, the statistics now show that OICs are being accepted at has dramatically risen over the past few years.

Take our brief survey and see if you qualify to negotiate your tax debt today!Part of the reason why OIC acceptances are so high is due to Americans turning to tax relief firms to put together their case against the IRS. As with anything, having a professional on your side brings an added advantage, and Americans have started to secure their OICs by having professional tax relief firms put together their case. Check to See if You Qualify Even if you looked into the IRS Fresh Start Program in the past, the program is constantly changing to be more accessible to taxpayers in need. Answer a few short questions and be on your way to financial freedom from the IRS.