As Inflation Rises, the Federal Government Increases IRS Funding by Billions of Dollars! The IRS Forgives Millions in Tax Debt to Combat Inflation, and Taxpayers Seek the Best Relief Through the IRS Fresh Start Program.

Unprecedented Inflation is ravaging Americans. The price of food, gasoline, and housing has suffered as a result.

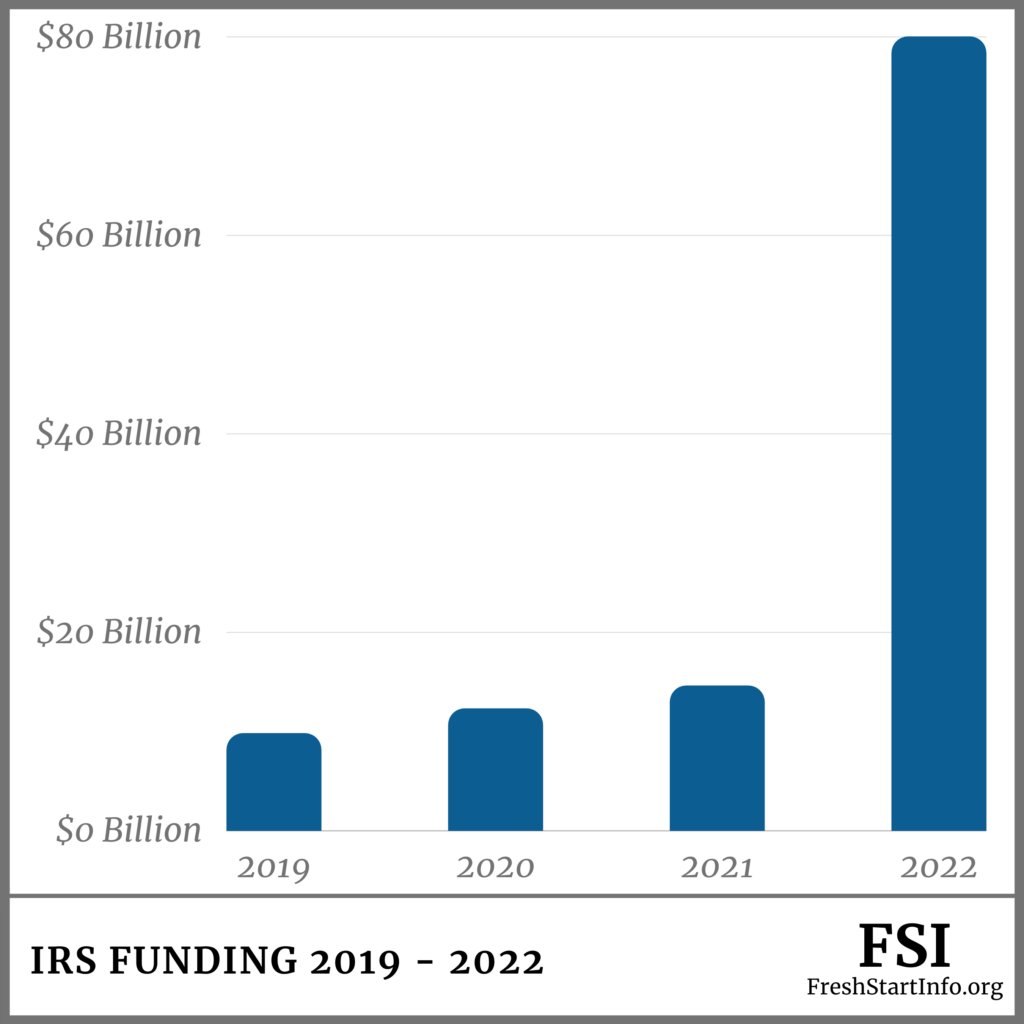

To make it easier on the American people, the Federal Government released one of the largest funding packages to the IRS, to date. (as seen in figure a.)

This means the IRS more than ever before is able to help Americans who owe taxes or have unfiled tax years.

Due to the large funding, the IRS can now waive penalties for many taxpayers who can’t pay their taxes because of financial hardships.

In more and more cases, even most of the tax debt is forgiven. This is great news for taxpayers who are struggling to pay their taxes. Find out if you can qualify for a total reduction by taking this free tax relief survey.

As inflation rises, taxpayers seek the best relief through the IRS Fresh Start Program.

Why is now the time to seek relief? Due to inflation, the IRS requirements to qualify for a reduction, and in some cases forgiveness of tax debt, are more lenient than ever before.

However, many American taxpayers are completely in the dark about how to qualify for relief programs with the IRS.

FreshStart Info makes it easy to see if taxpayers qualify for relief options with the IRS. Qualifying is free, easy, and takes 2 minutes.

If you can relate to this or have concerns about being behind on your taxes, take a moment to fill out the free tax relief survey. This survey will help you better understand if you can qualify to have your past-due taxes settled for pennies on the dollar, or in some cases, eliminated entirely. It only takes 2 minutes to fill out. Learn more about how to get your IRS debt handled, and start living debt-free.